Exempt vs. Non-Exempt Status (Updated for 2025)

Do you pay your employees hourly or salaried? Are you tracking each hour worked to determine when/if there is overtime payment eligibility? Or are you paying a flat salary per week regardless of time worked?

How you pay your staff isn’t a matter of arbitrary discretion. There are several layered rules and regulations at both the state and federal level that determine how your employees must be paid. These rules vary based on factors like how much you are paying the employee, your industry, and even what the responsibilities of the individual employees are. One of the most overarching and misunderstood factors in determining how you can pay an employee, is whether the employee’s position is considered exempt or non-exempt. The term “exempt” refers to a position’s exemption from needing to be paid a minimum hourly rate, as well as exemption from the requirement to pay overtime for hours worked over 40 in a workweek. This is why exempt positions are typically associated with paying employees a fixed salary, because there is no need to track hour for overtime or hourly rate purposes. If a position is “non-exempt”, or not exempt from the minimum hourly wage and overtime requirements, then those requirements still apply, which is why non-exempt employees are typically paid on an hourly basis (there is a need to track hours to determine overtime eligibility).

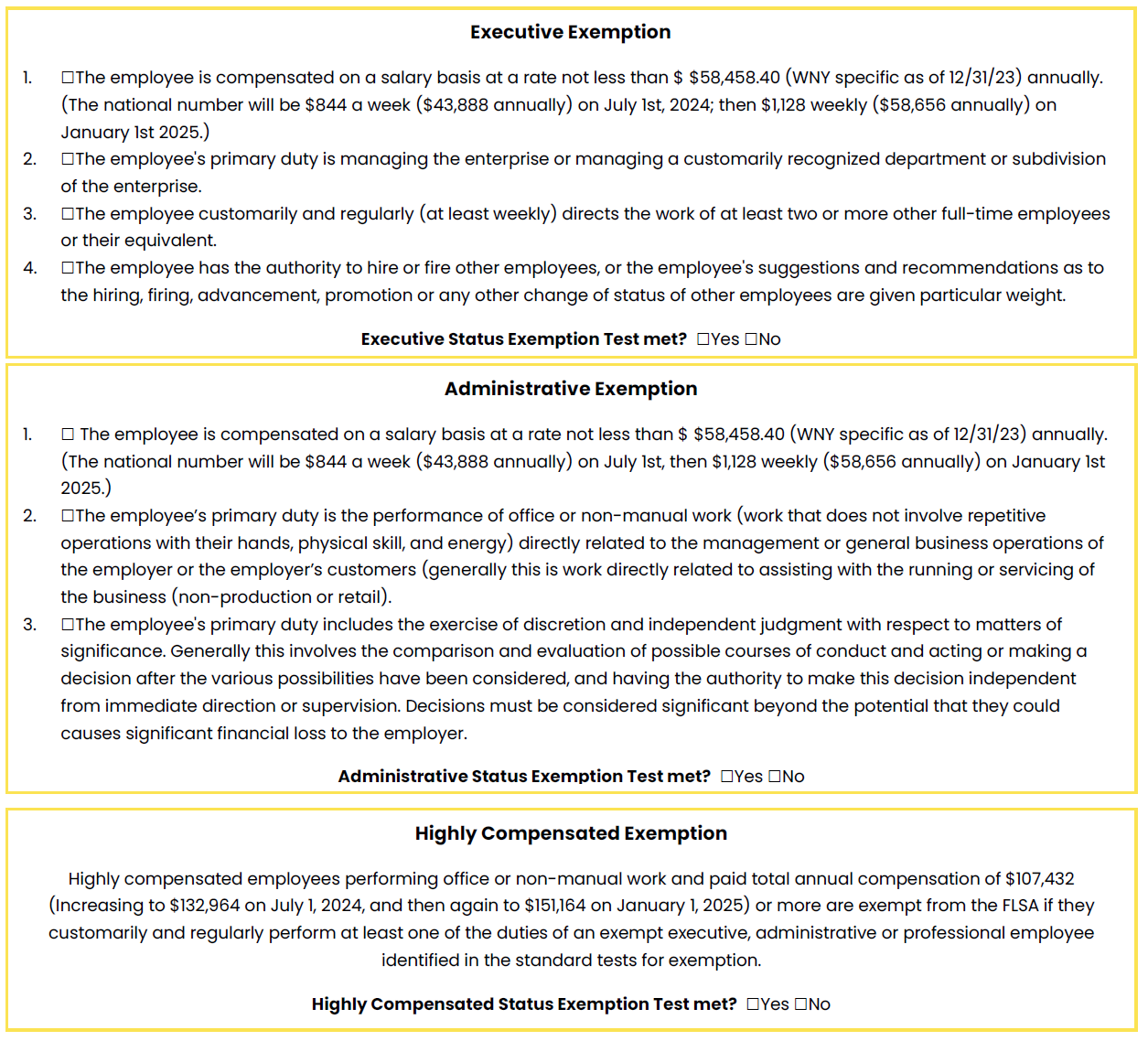

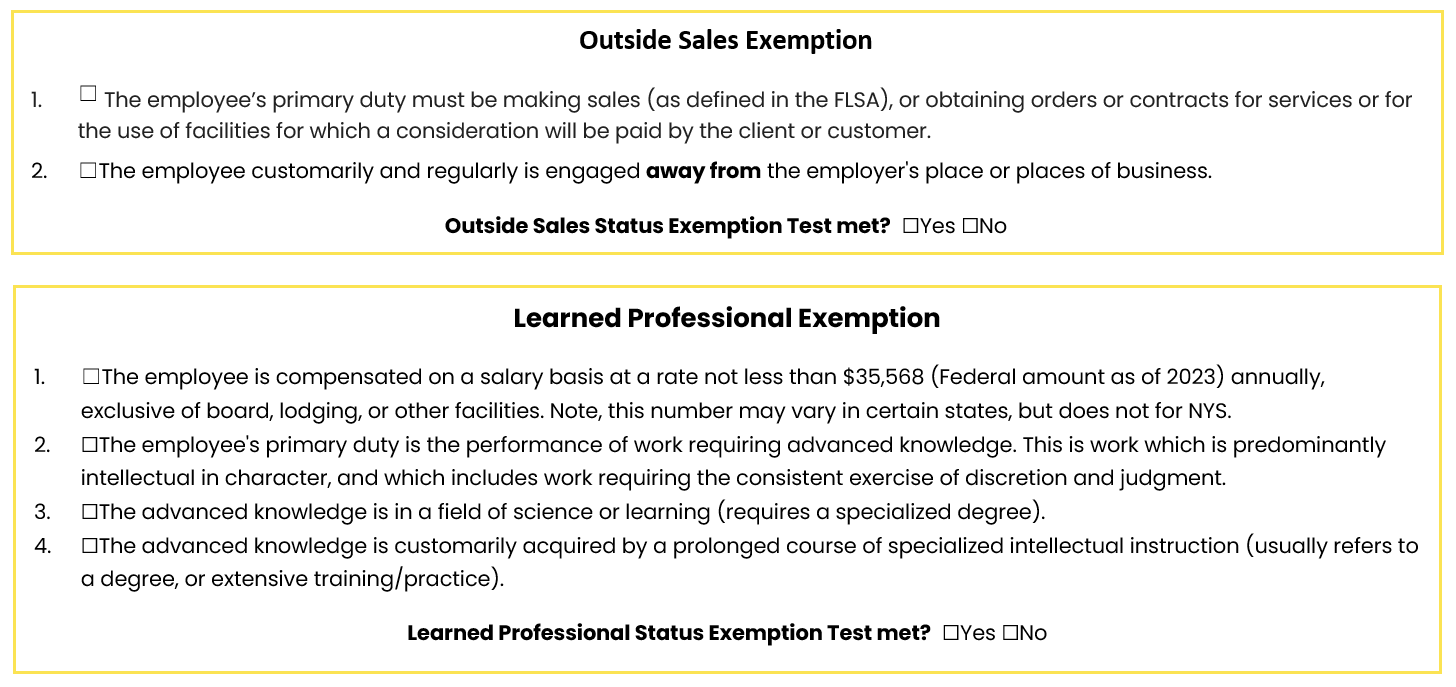

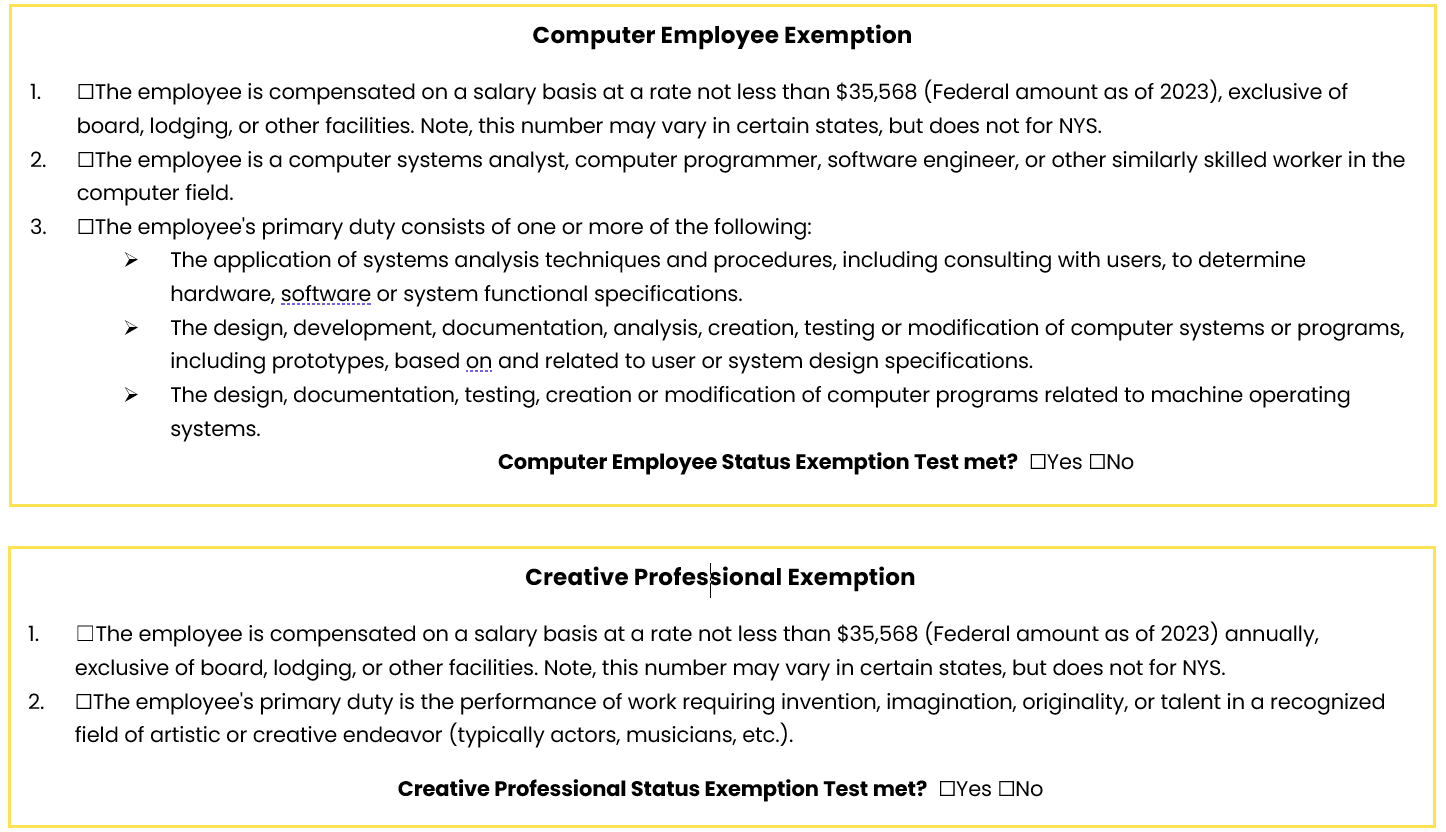

To help guide you in this decision making, we’ve provided a checklist below which outlines the most common categories available for a position to safely qualify as exempt. Here are some other quick notes to keep in mind as you use this checklist and assess the roles within your organization:

Note that each category has both a minimum salary amount component AND a “duties test” component. A position must check every box within each available category to qualify as exempt.

It is always safest to default an employee to non-exempt status when you are unsure at all about exemption qualification (tracking and paying for hours worked, and paying OT). This is always considered most beneficial to the employee by the DOL, so this is always the safest route. Most employees fall under this status anyway.

The minimum salary amount for exemption status (not unlike the minimum hourly wage), has been increasing annually for multiple years, and is likely to do so going into the future. Make sure to check this number at the end of each year and adjust accordingly (either the employee’s salary OR their status to non-exempt).

For the duties test portion of the qualification, the employee’s position in real life (not just based job title or aspirational job descriptions), must meet the requirements. These means what they really do day-to-day.

Different industries, states, and other qualifying factors may have stricter or looser requirements than what is indicated here based on other rules in place. To be certain about whether you’re correctly paying employees, we recommend reaching out to a professional for a review of this part of your payroll process.

This area of employment law compliance is highly sought after and targeted for audits and claims, and the DOL has signaled this will be increasingly the case in the coming years. If you are found to be incorrectly classifying and paying employees, you could be subject to back pay for inadequate salary, “unpaid” and past due overtime, or other wages for up to 6 years, AND significant liquidated damages on top of that amount. These numbers can add up extremely quickly, and the burden of proof to defend yourself is very high. Moral of the story? You should be taking this very seriously, and if you have any doubt, we recommend a professional review.

Note: On 11/15/24 a Federal court struck down the planned 1/1/25 exempt (salary) increase, as rolled back the 7/1 requirement as well. 2025 increases for NYS still apply, but as of the date of this note (11/18/24) the increase nationally is put on hold. This is an ongoing and developing topic and we encourage you to subscribe to our newsletter and check back here to stay updated on your requirements.